Painstaking Lessons Of Info About Cash Forecasting Model Excel

Understanding the data is crucial, including identifying variables, cleaning and organizing.

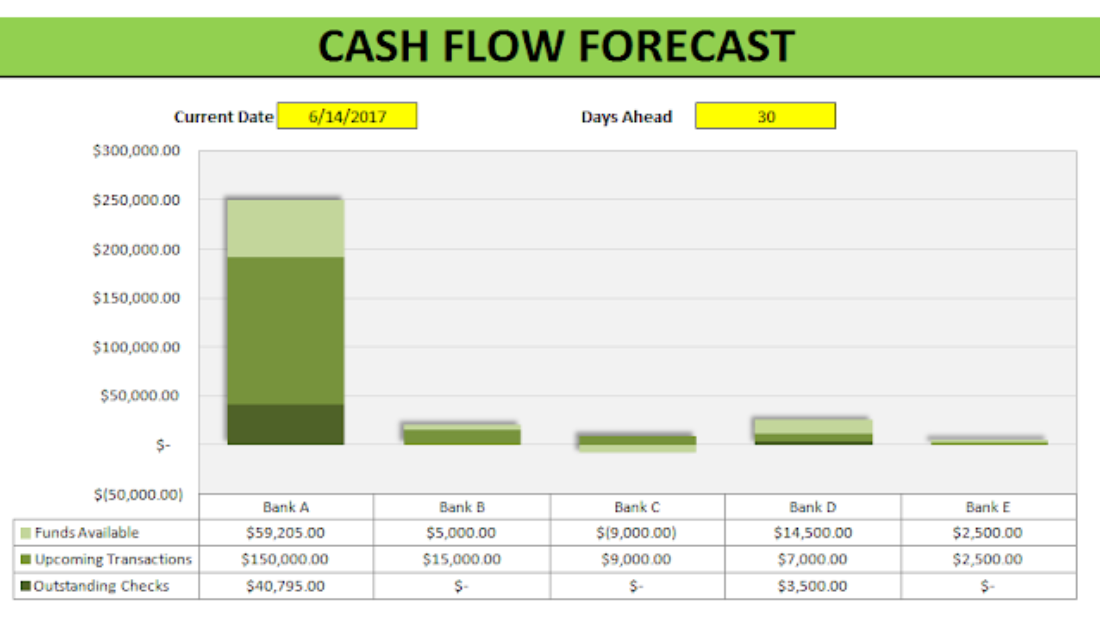

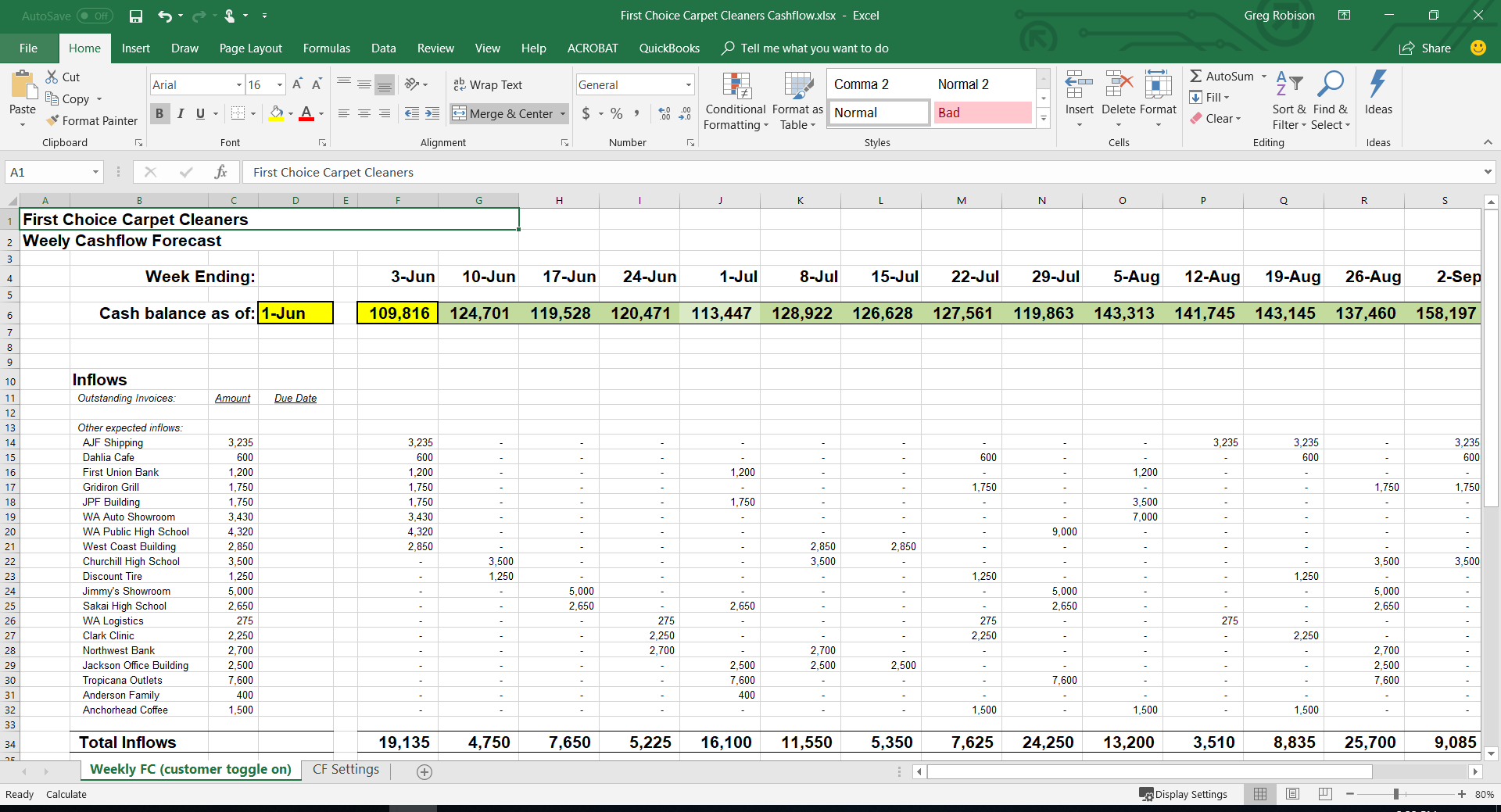

Cash forecasting model excel. That means every business—regardless of its. Know why it's important, and how to use a free excel template. Create a basic cash flow forecast using excel.

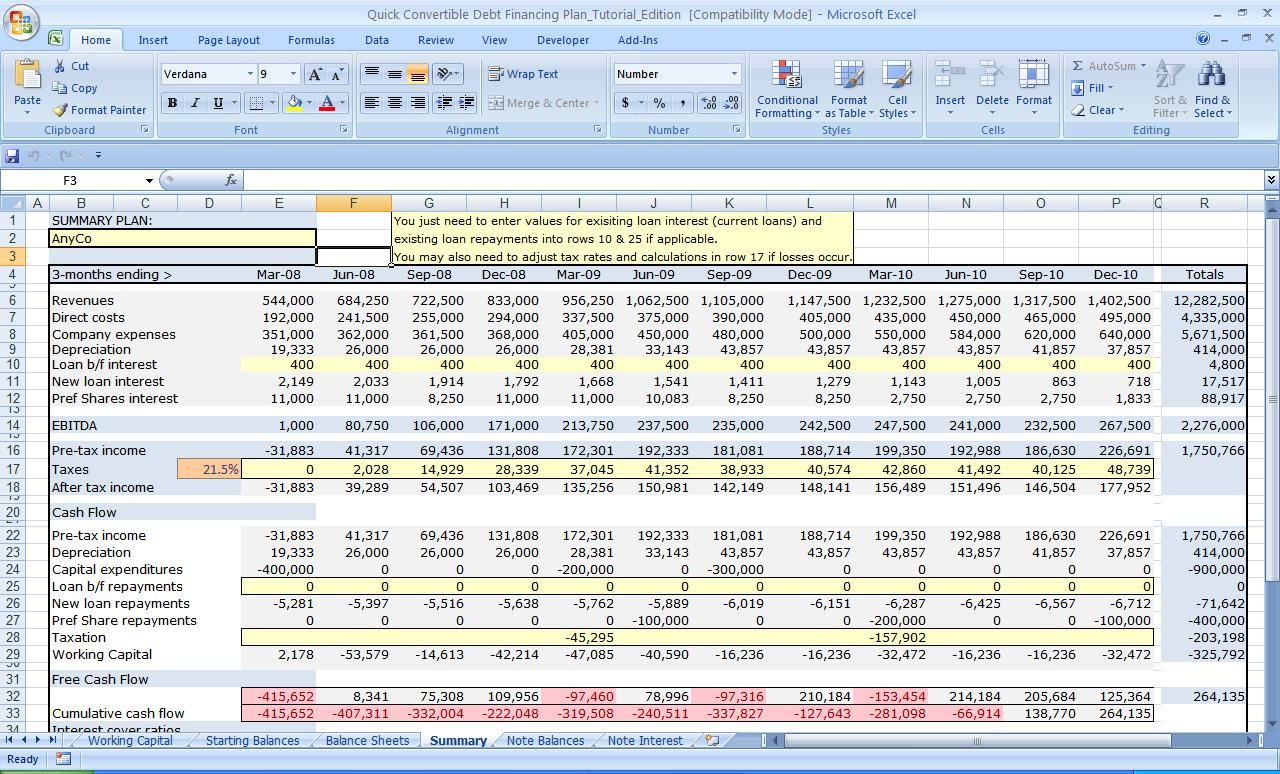

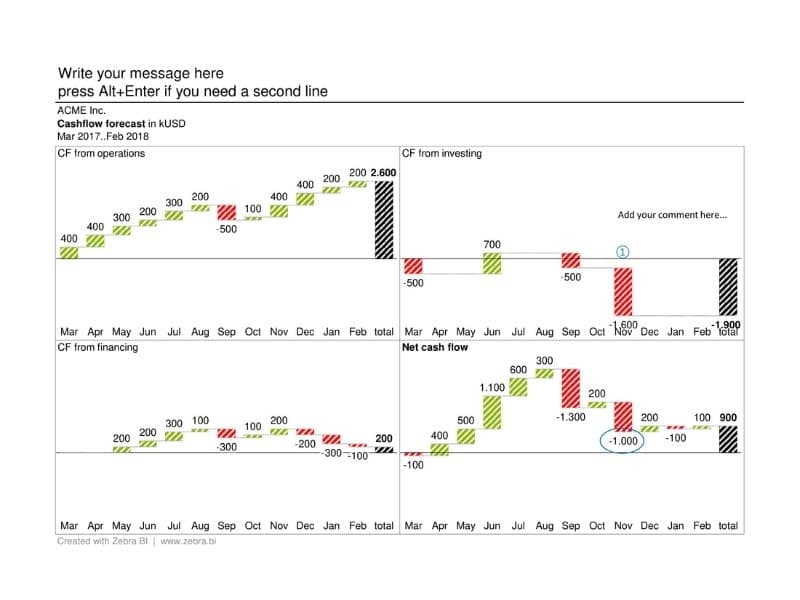

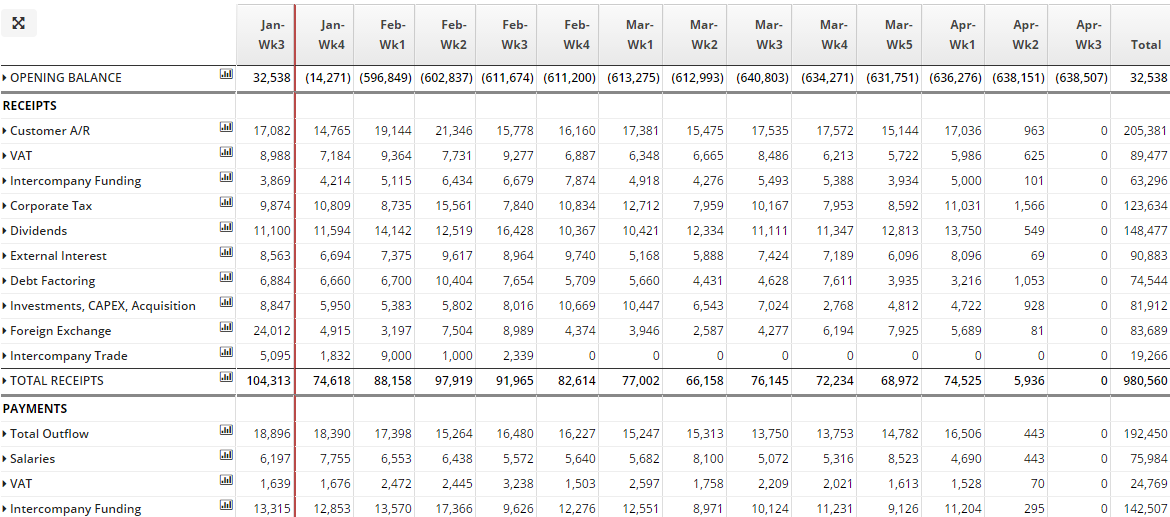

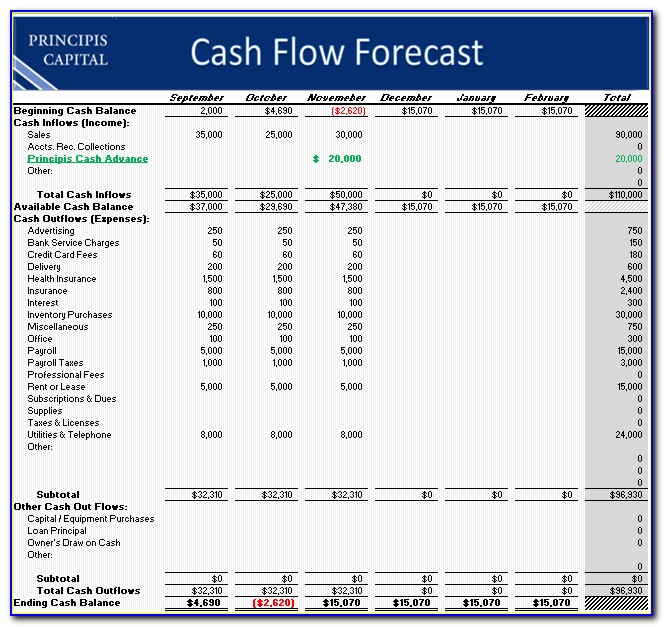

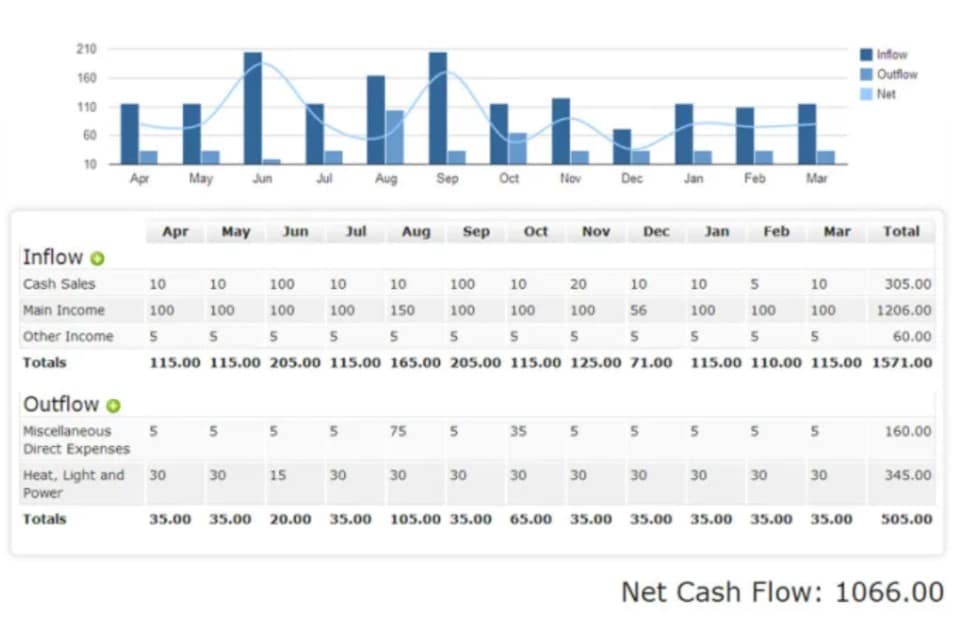

A cash flow forecast (also known as a cash flow projection) is like a budget, but rather than estimating revenues and expenses, it estimates cash coming in and going out based on. Derive a forecast cash flow statement, a. Cash flow modeling allows planners to predict future cash flows by incorporating revenue, expense, capital expenditure and other inputs.

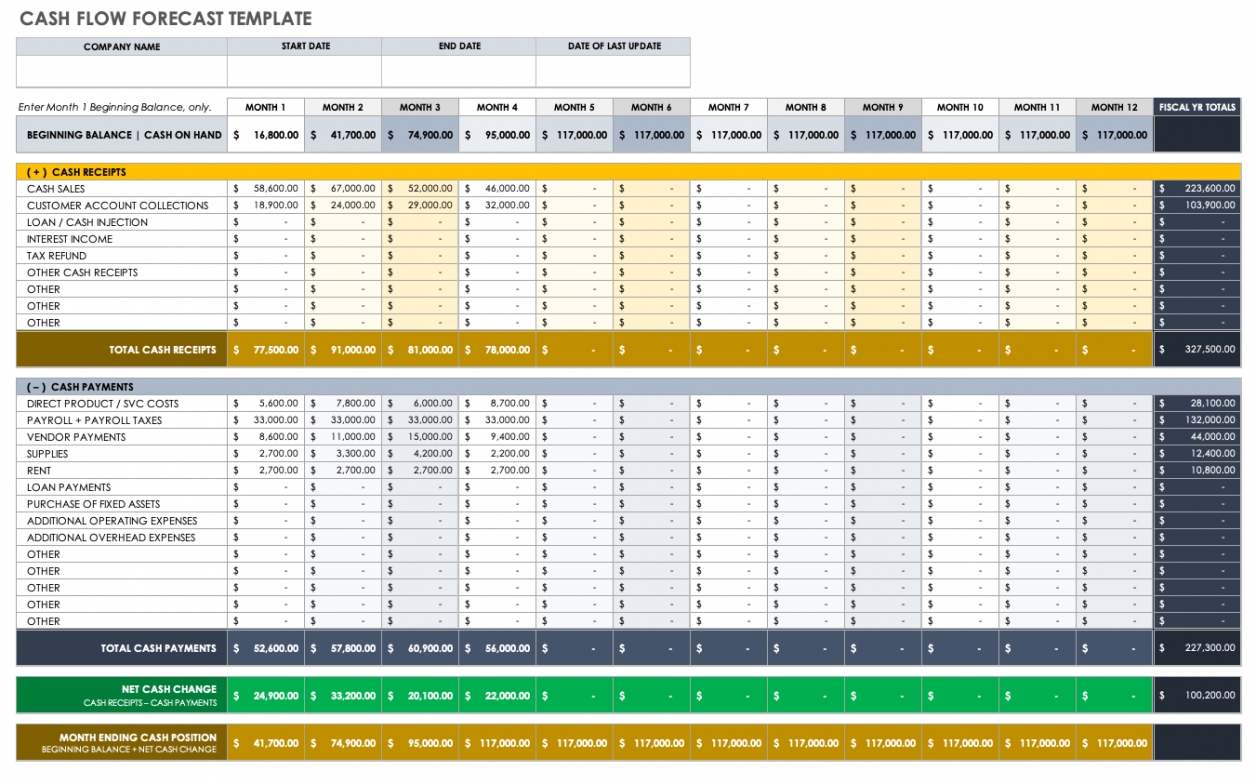

Choose among the many excel financial model templates to help you prepare budgets, financial plans, business plans, and cash flow projections for businesses. Excel creates a new worksheet that contains both a table of the historical and predicted values and a chart that expresses this data. List all the business drivers of your cash flow forecast in one excel sheet.

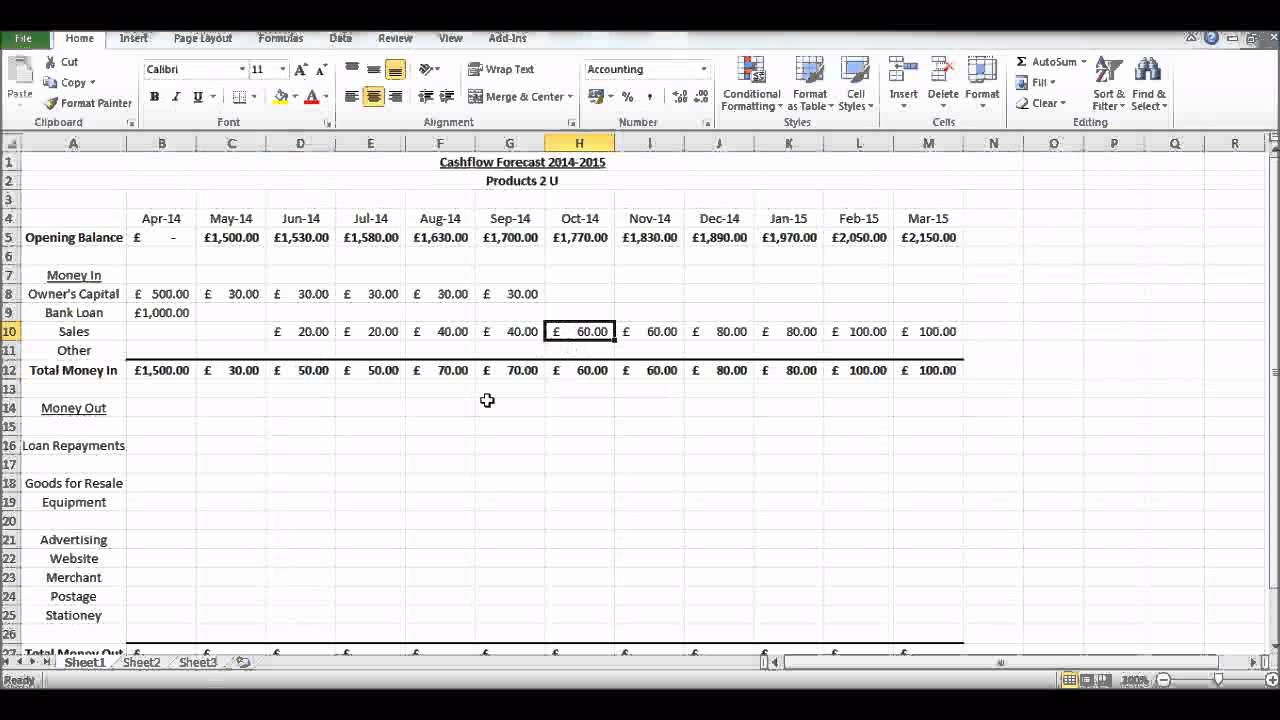

Annual cash flow projections are based on user defined turnover, gross. The tutorial explains how to layout the sheet and where to add the sums and functions. Forecasting is the technique to estimate future trends based on historical data.

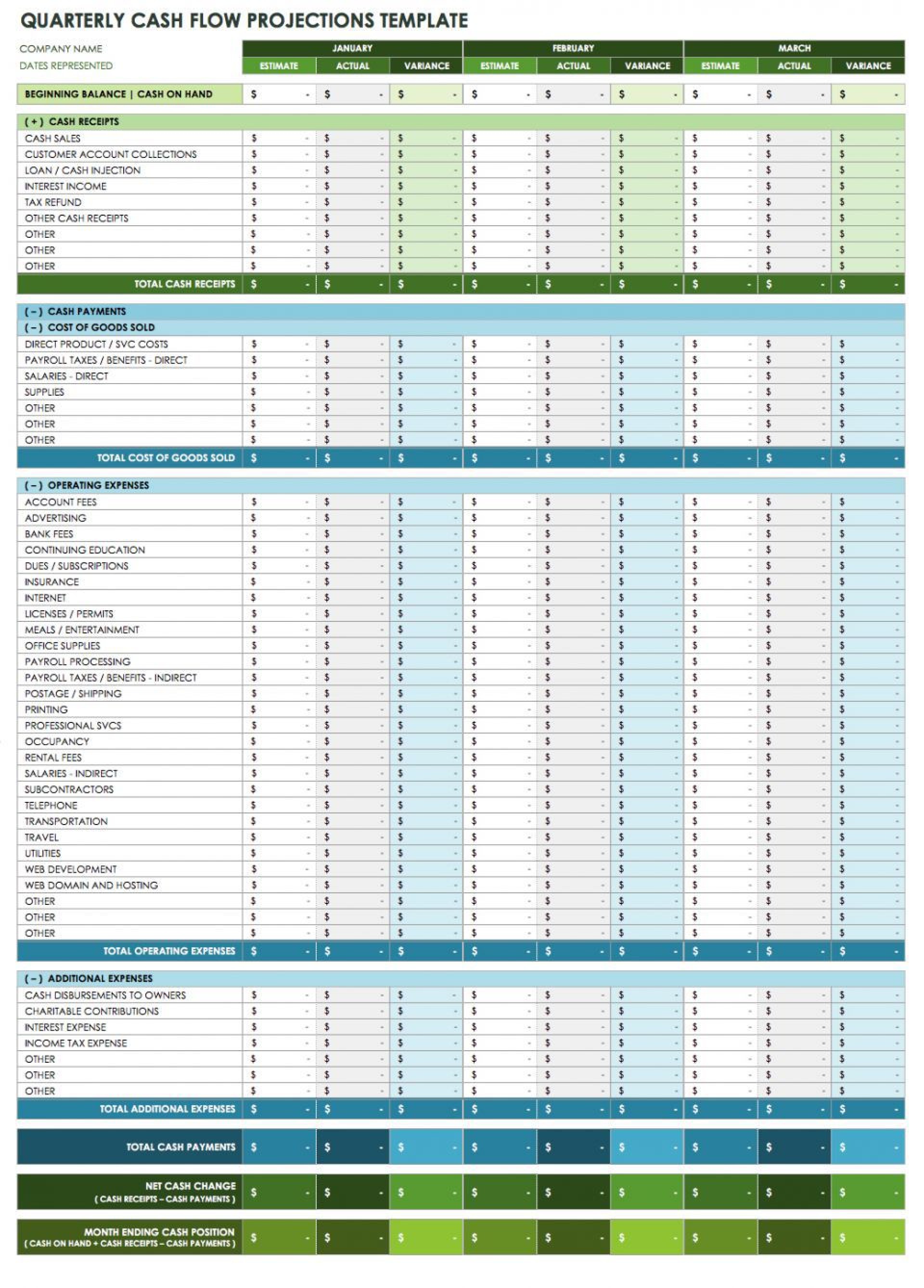

This video explains how to create a cash flow forecast in microsoft excel. With a rolling monthly cash flow forecast, the number of periods in the forecast remains constant (e.g., 12 months, 18 months, etc.). This template is useful for business managers, accounts managers, cashiers.

A company’s ability to produce positive cash flows over the long run determines its success (or failure). Use this cash flow forecast template to create annual cash flow projections in excel for 5 annual periods. You'll find the new worksheet just to the left.

If you need help get in contact. Use one of the columns to explain the assumptions and their origin further. For example, company a made sales worth $5000 in.

Monthly forecasts establish limits on a company’s spending based on income and retained. What does the process entail?