Favorite Info About Excel Sheet For Calculation Of Income Tax

![Tax Calculator FY 202324 Excel [DOWNLOAD] FinCalC Blog](https://imgv2-1-f.scribdassets.com/img/document/48916532/original/6d870869c1/1590429316?v=1)

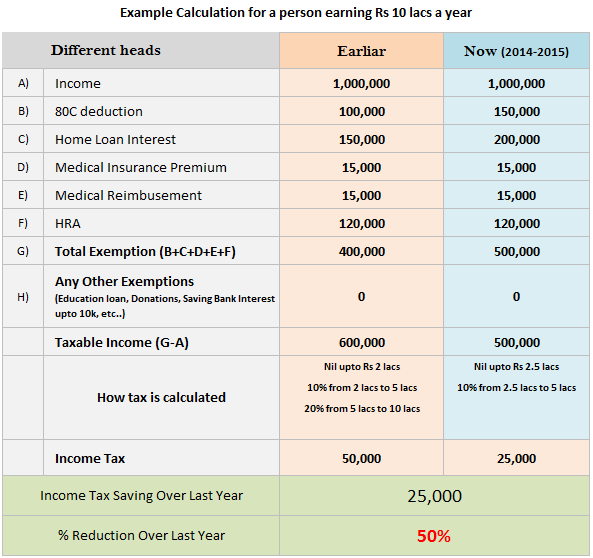

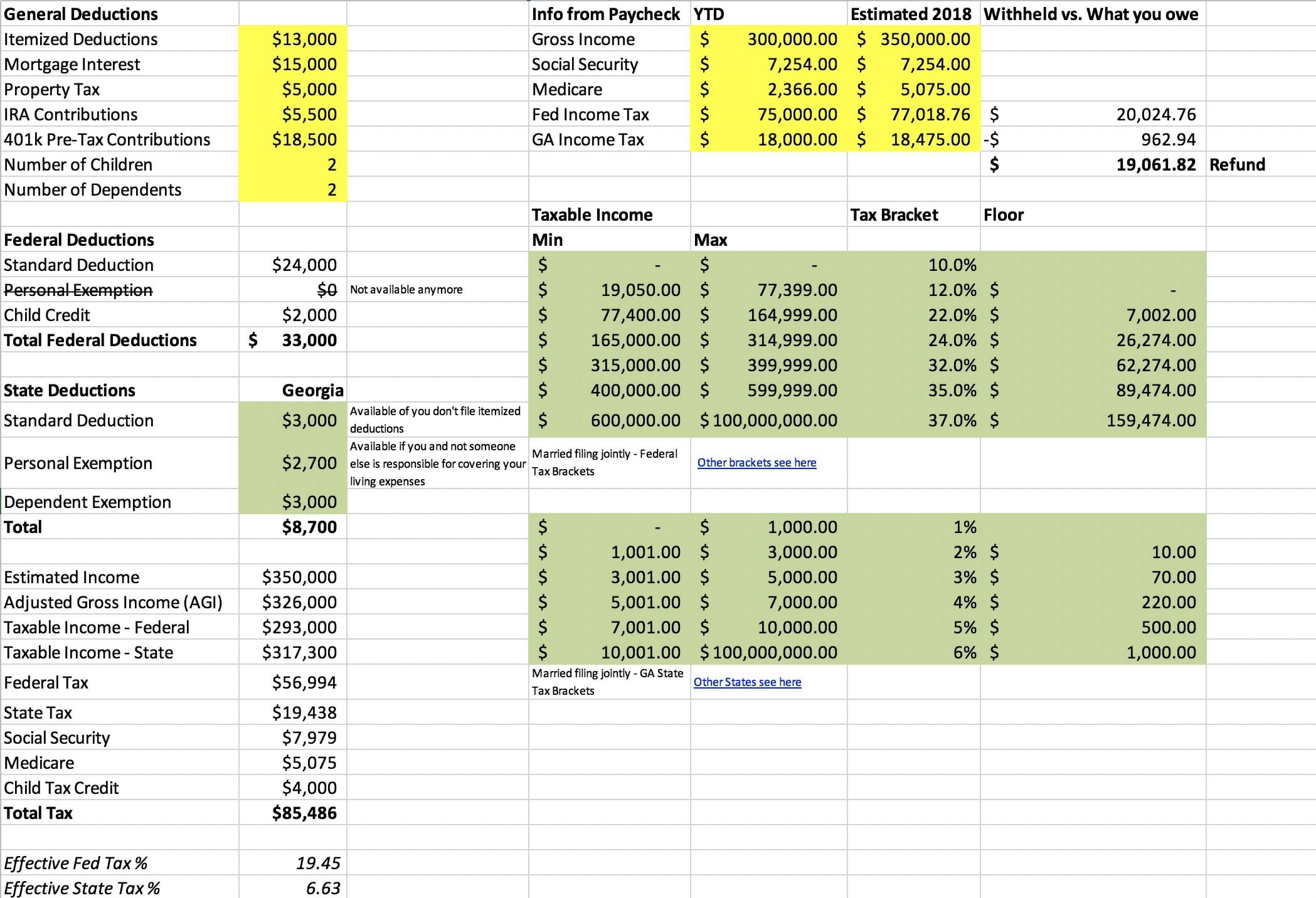

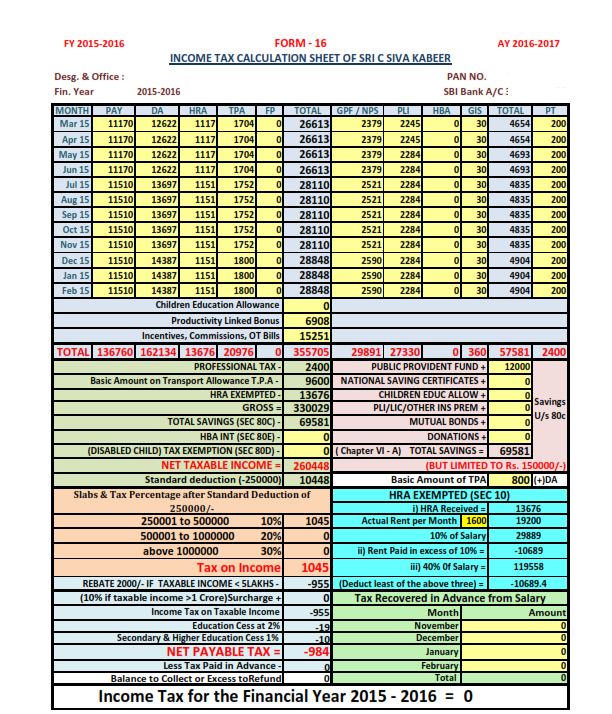

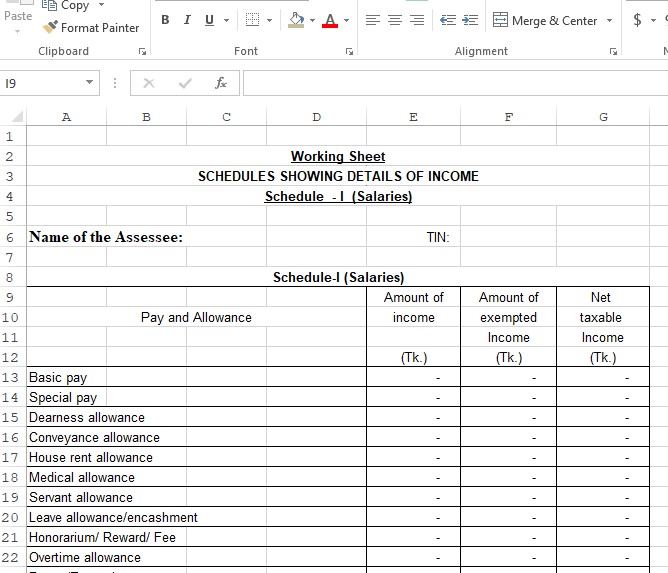

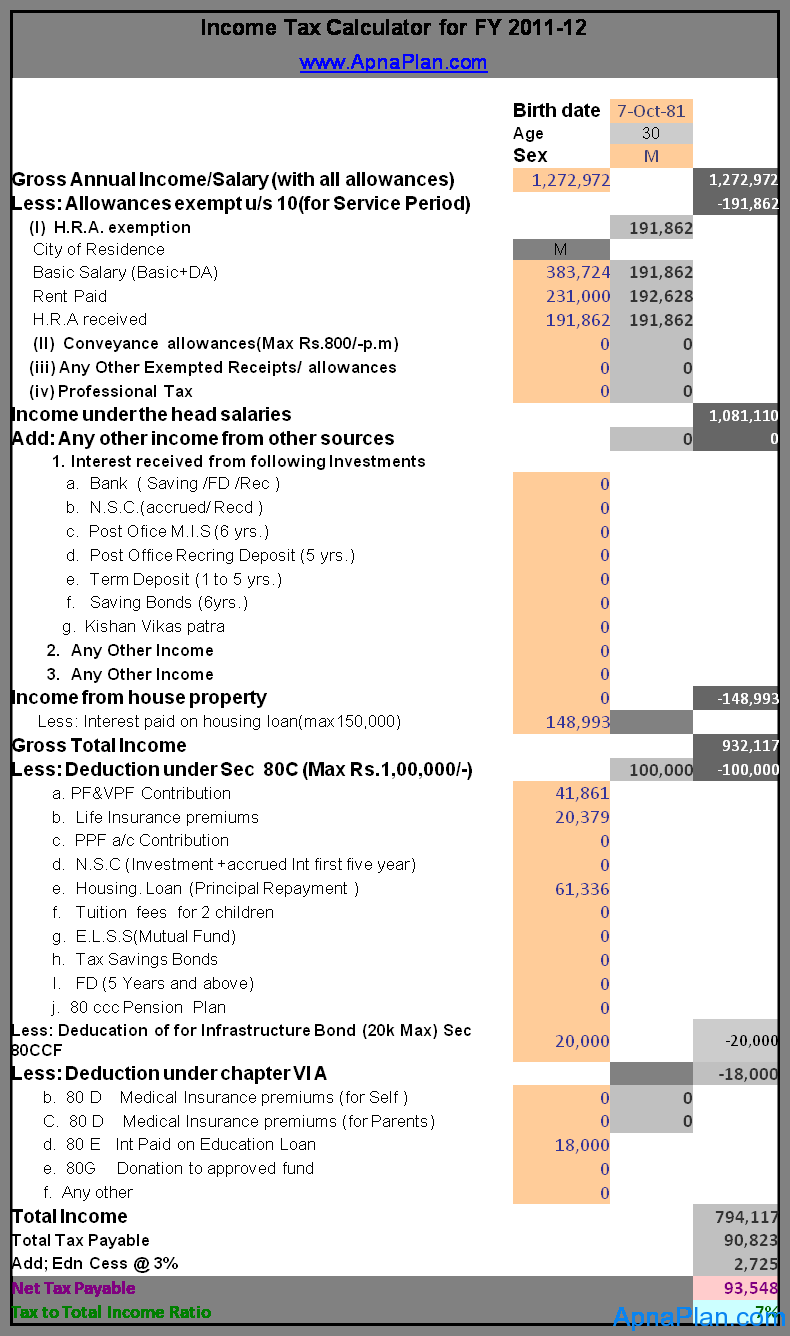

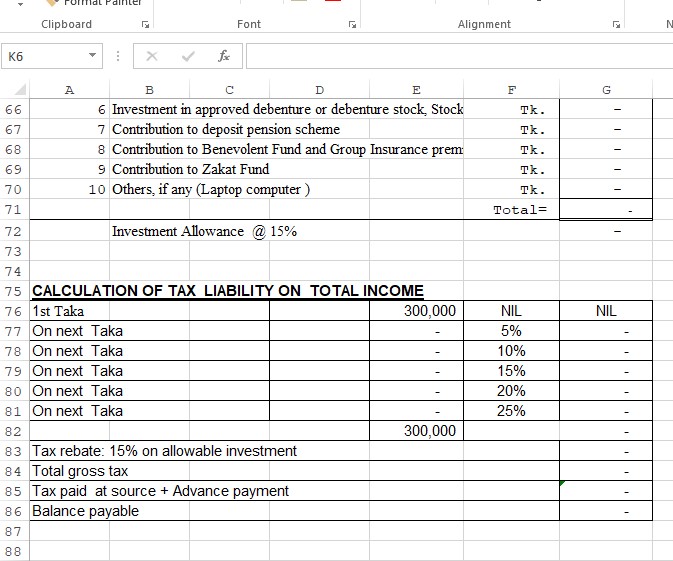

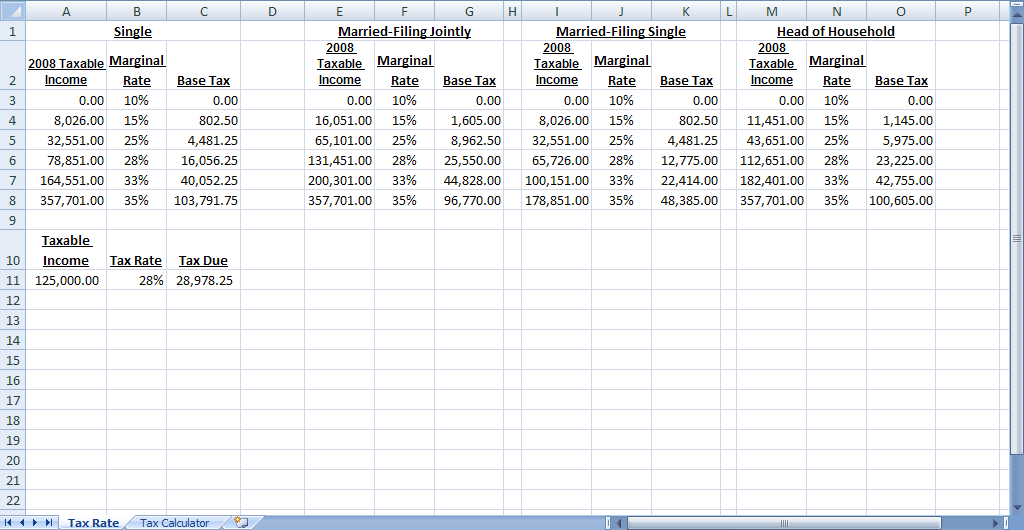

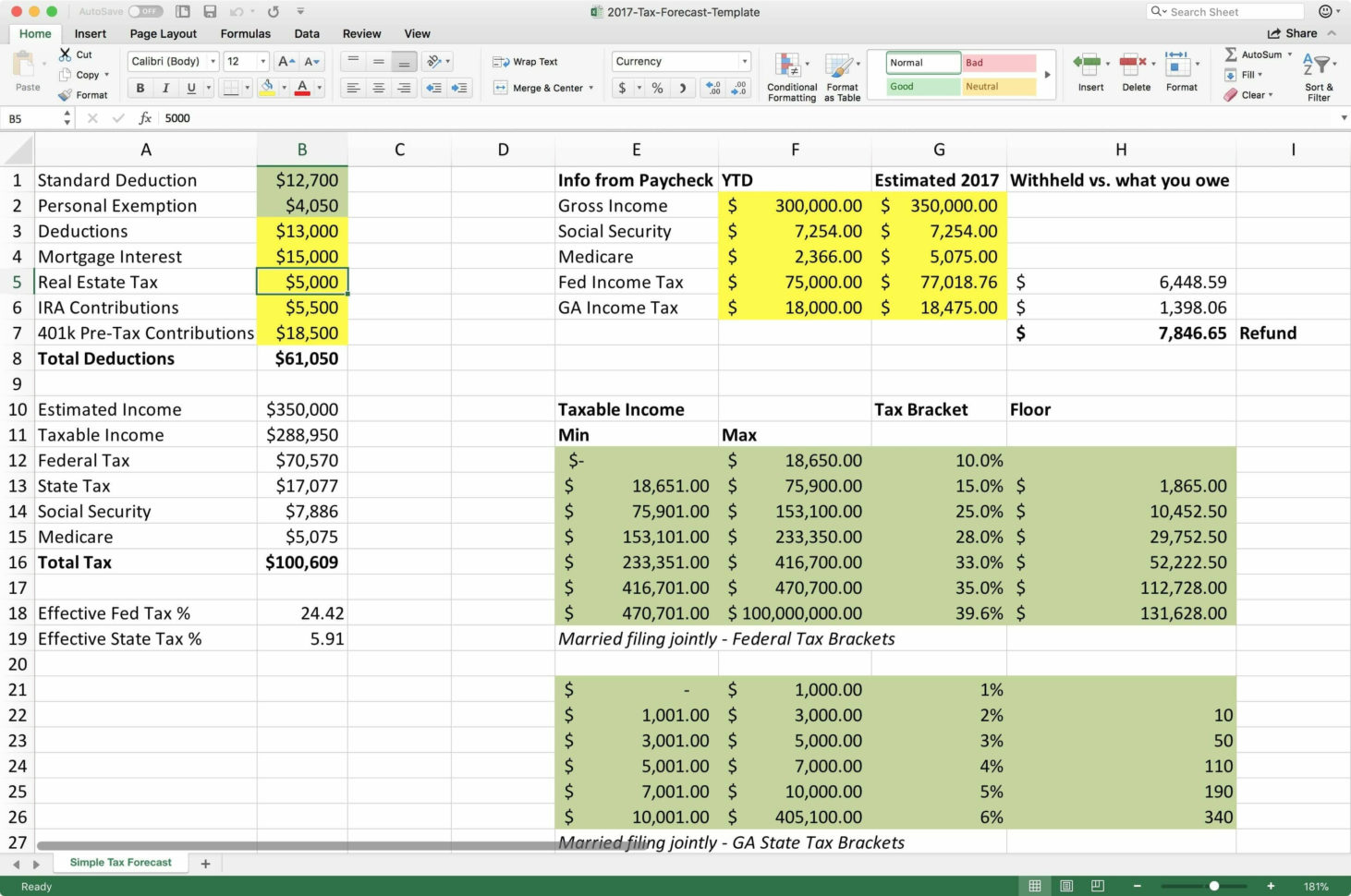

Using excel functions to calculate income tax explore the various excel functions that can be utilized to calculate income tax based on taxable income, tax brackets, and rates.

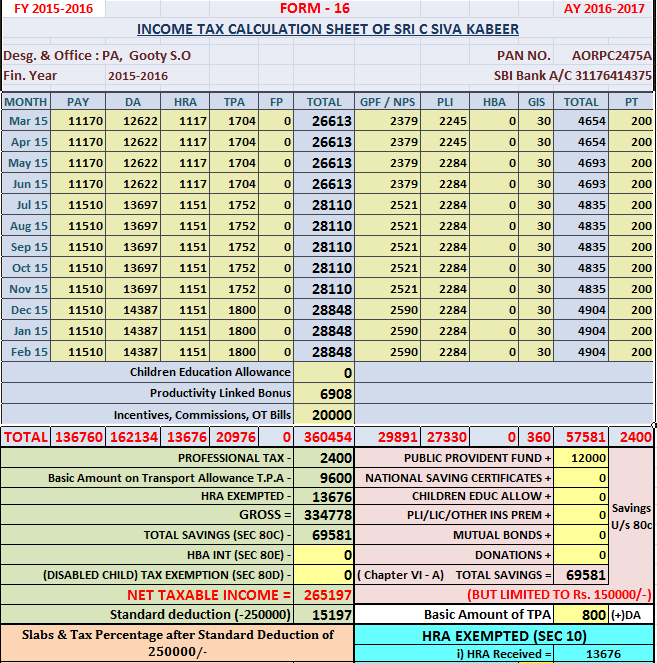

Excel sheet for calculation of income tax. Now you can calculate 5% of the taxable income. Click on the download link. Perform annual income tax & monthly salary calculations based on multiple tax brackets and a number of other income tax & salary calculation variables.

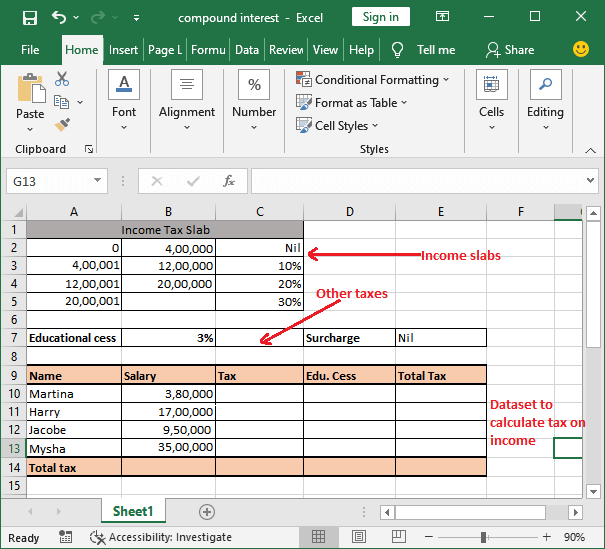

Set up income tax slab we need to prepare the income tax slab first. Suitable for salaried employees and business owners. We want to enter a taxable income and have excel compute the tax amount, the marginal tax rate, and the effective tax rate.

For example, if the income is less than $50,000, the tax rate is. Usage in income tax calculation: No penalty will be charged if taxpayers pay by march 31,.

| download income tax calculator in excel step 1: This excel calculator helps you to calculate income tax if you are salaried employee or business man. This auto income tax calculator tool will help you to calculate the tax and compare according to both regimes in very simple way and suggest you that which tax.

There are various tax rates that exist depending on the country and region. These all given incomes are taxable income. Yes no check out more online calculators here including income tax,.

Here is an example layout of tax bracket data in excel: How to use an income tax calculator in excel? Get the free tax tracker excel template make your tax preparation a breeze with this free template to speed this process up a bit, you can start by downloading an excel copy of.

You can use an excel income tax calculator by following these steps: This excel calculator helps you to calculate income tax if you are salaried employee or business man. You can use if formulas to determine the tax rate based on income levels.

It gives the amount of tax you should pay. Yes no check out more online calculators here including income tax,. In this section you can specify whether you qualify for small business tax or normal taxes.

This idea is illustrated in the. Salary/ dividends mix optimisation update: Income range | tax rate;

![Tax Calculator FY 202324 Excel [DOWNLOAD] FinCalC Blog](https://fincalc-blog.in/wp-content/uploads/2023/02/how-to-calculate-income-tax-2023-24-excel-income-tax-calculation-examples-video-1024x576.webp)