Favorite Info About Family Budget Planner Excel

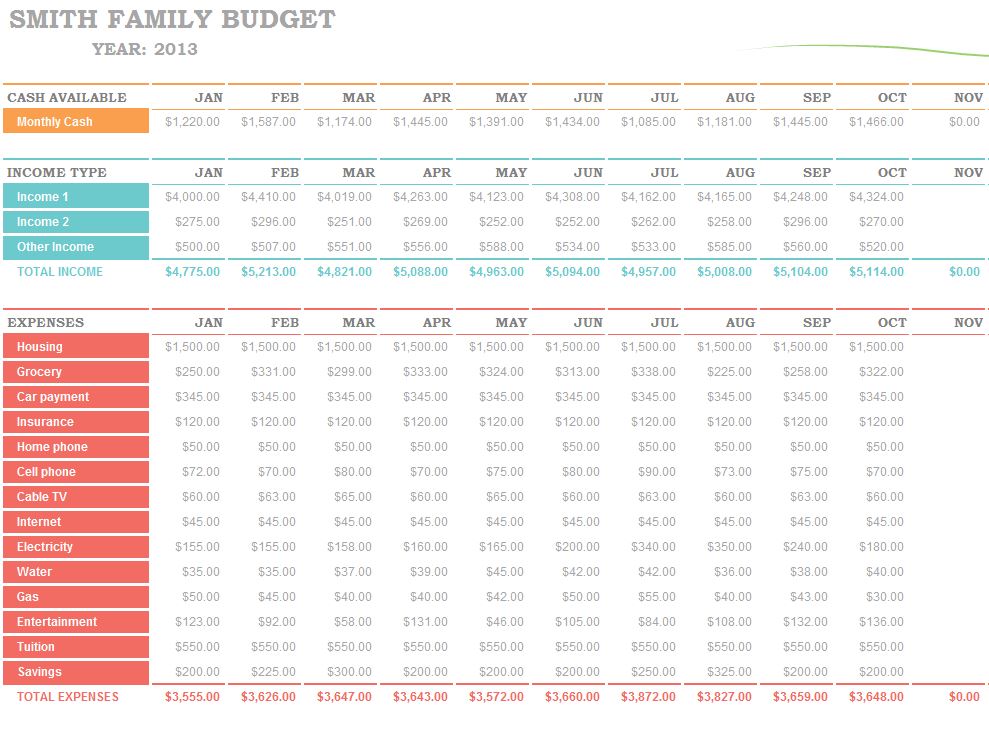

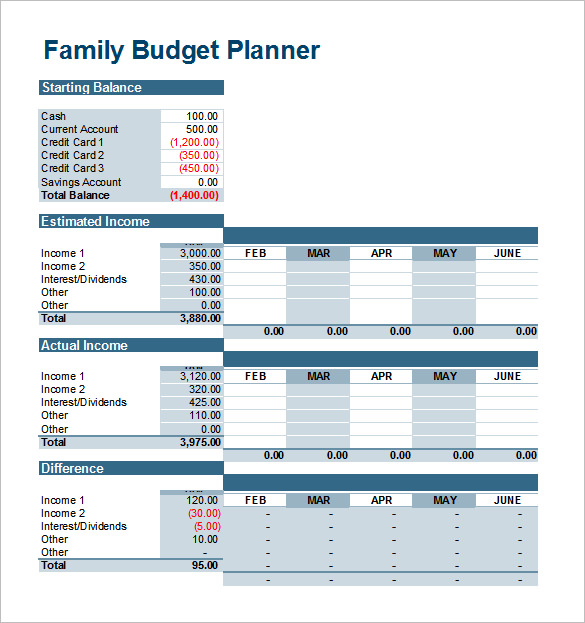

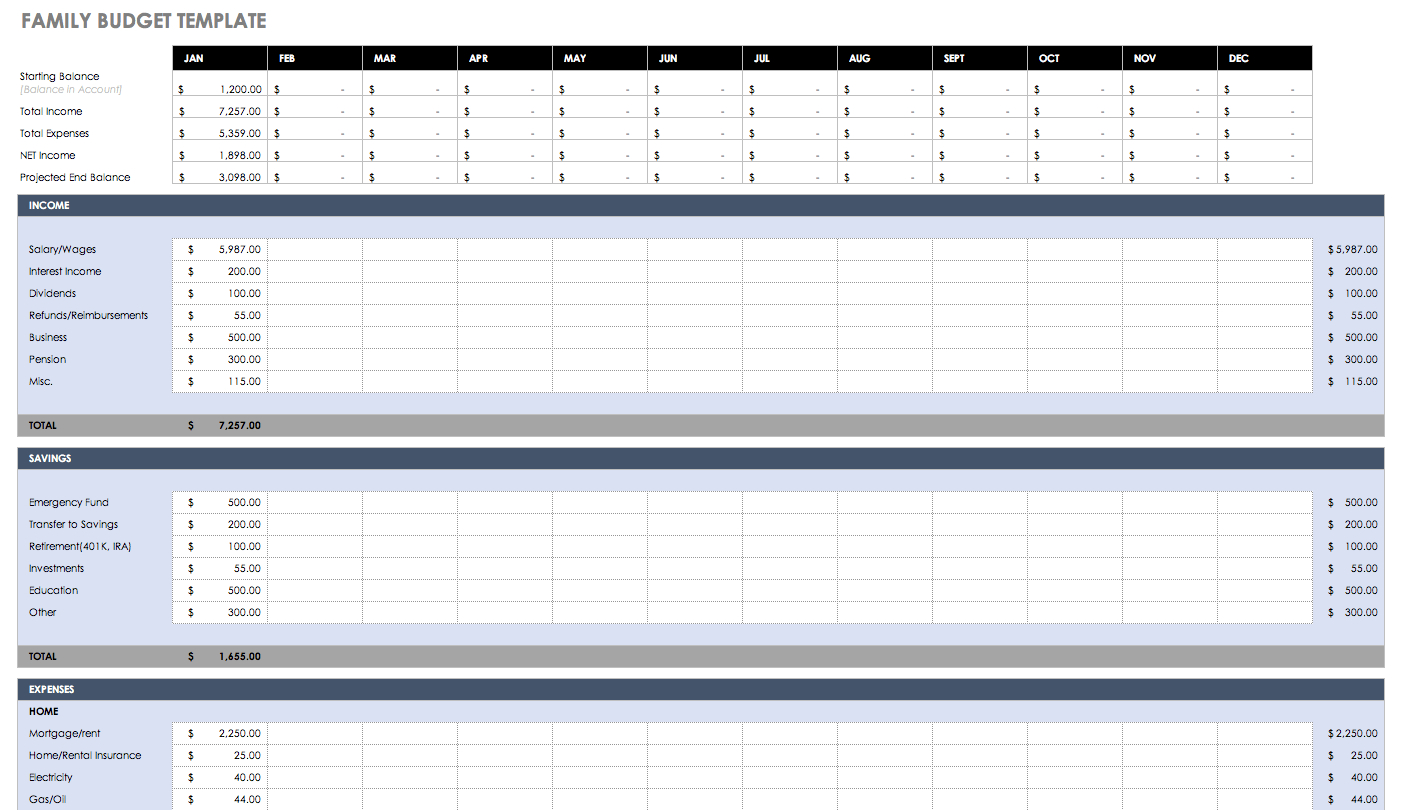

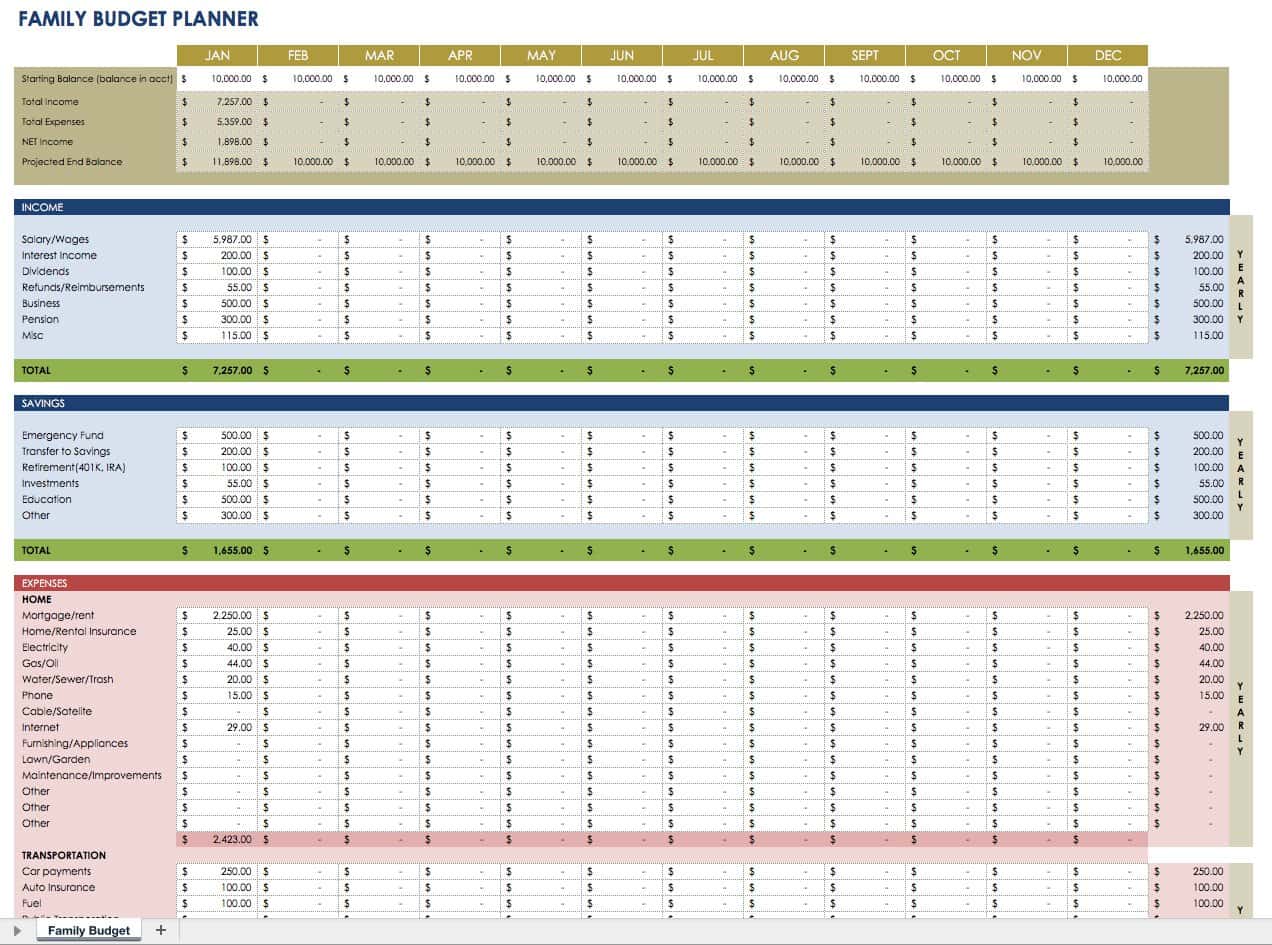

This free family budget planner worksheet will help you create a yearly budget by entering amounts based on the month in which expenses are incurred.

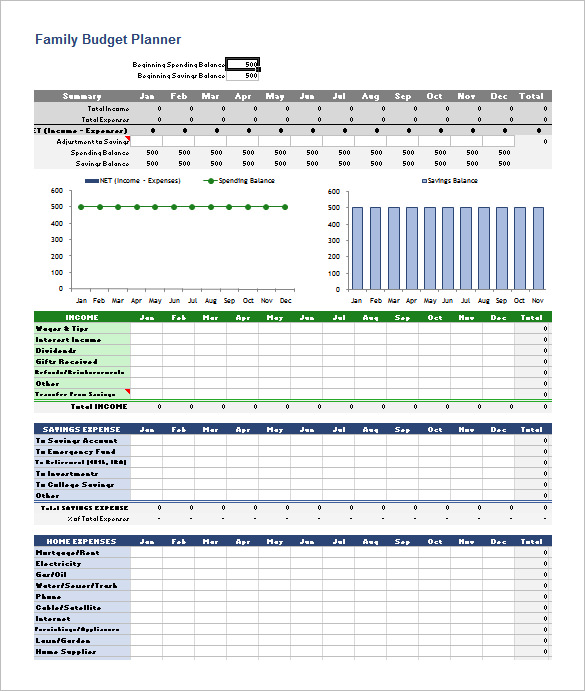

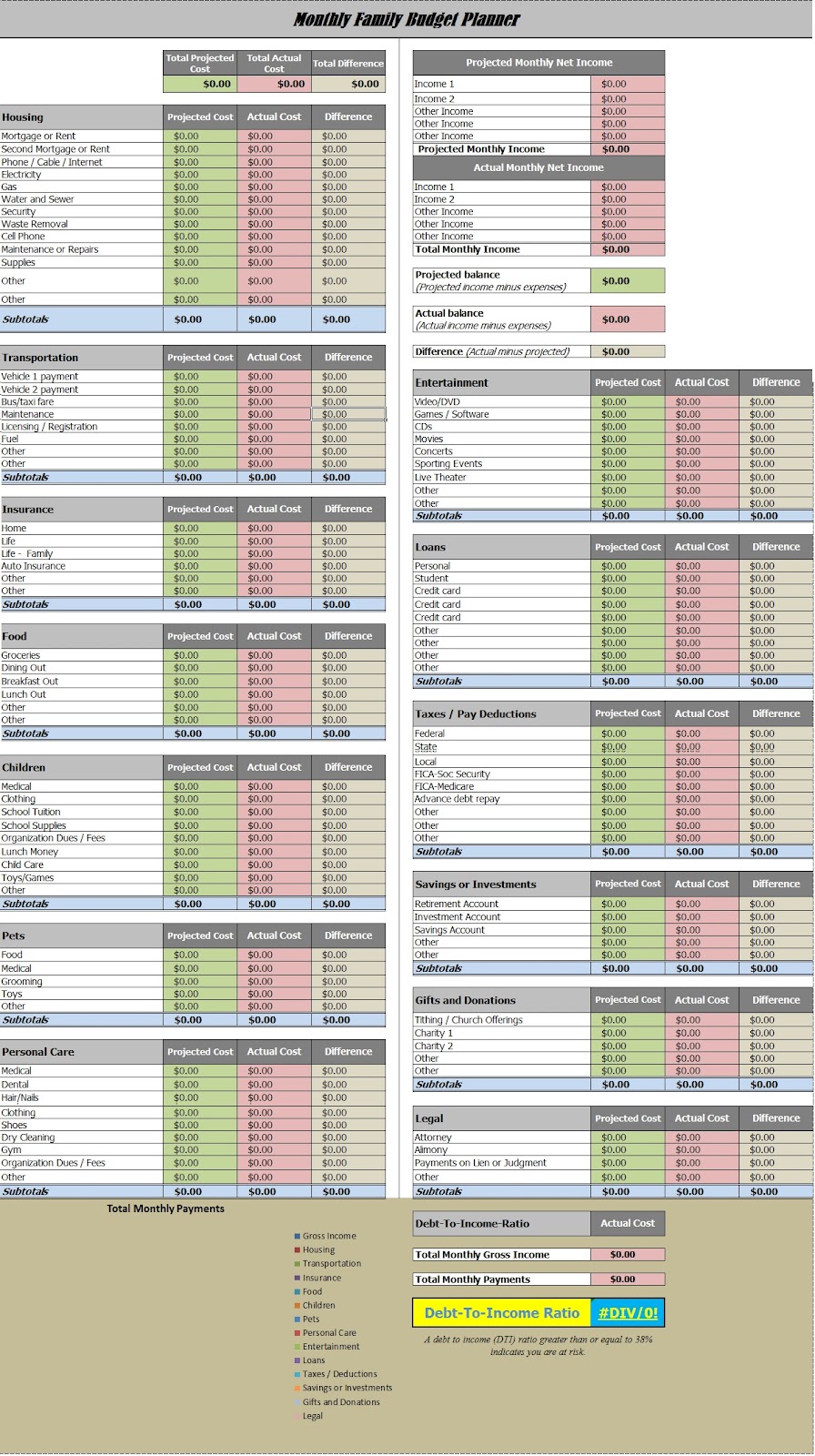

Family budget planner excel. What is family budget planner? How to use a family budget planner. It is a simple template that helps to track your budget monthly, quarterly and yearly.

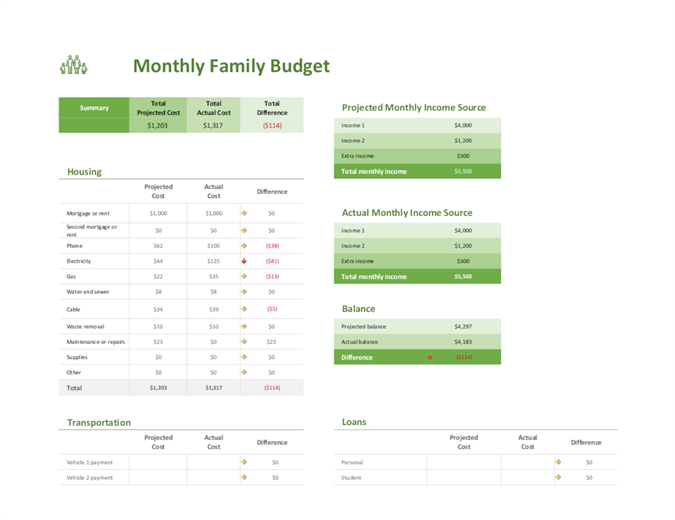

Find the best free budget template for your personal, business, or household needs. The family budget planner excel template consists of one chart and 3 tables. Gather bank statements, household bills and receipts.

The benefit of using a family budget. Save the budget spreadsheet: Excel provides a wide range of templates that can be accessed through the template gallery.

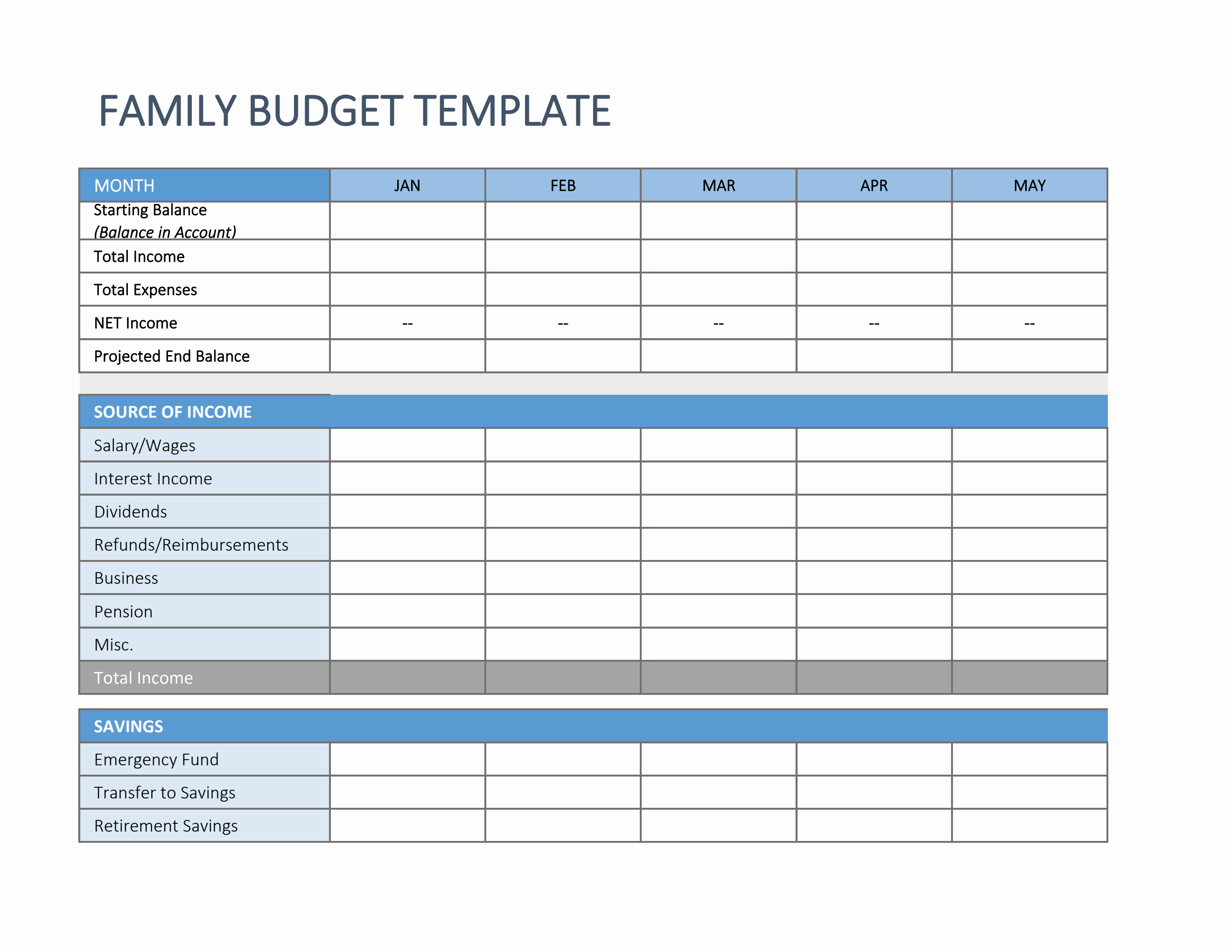

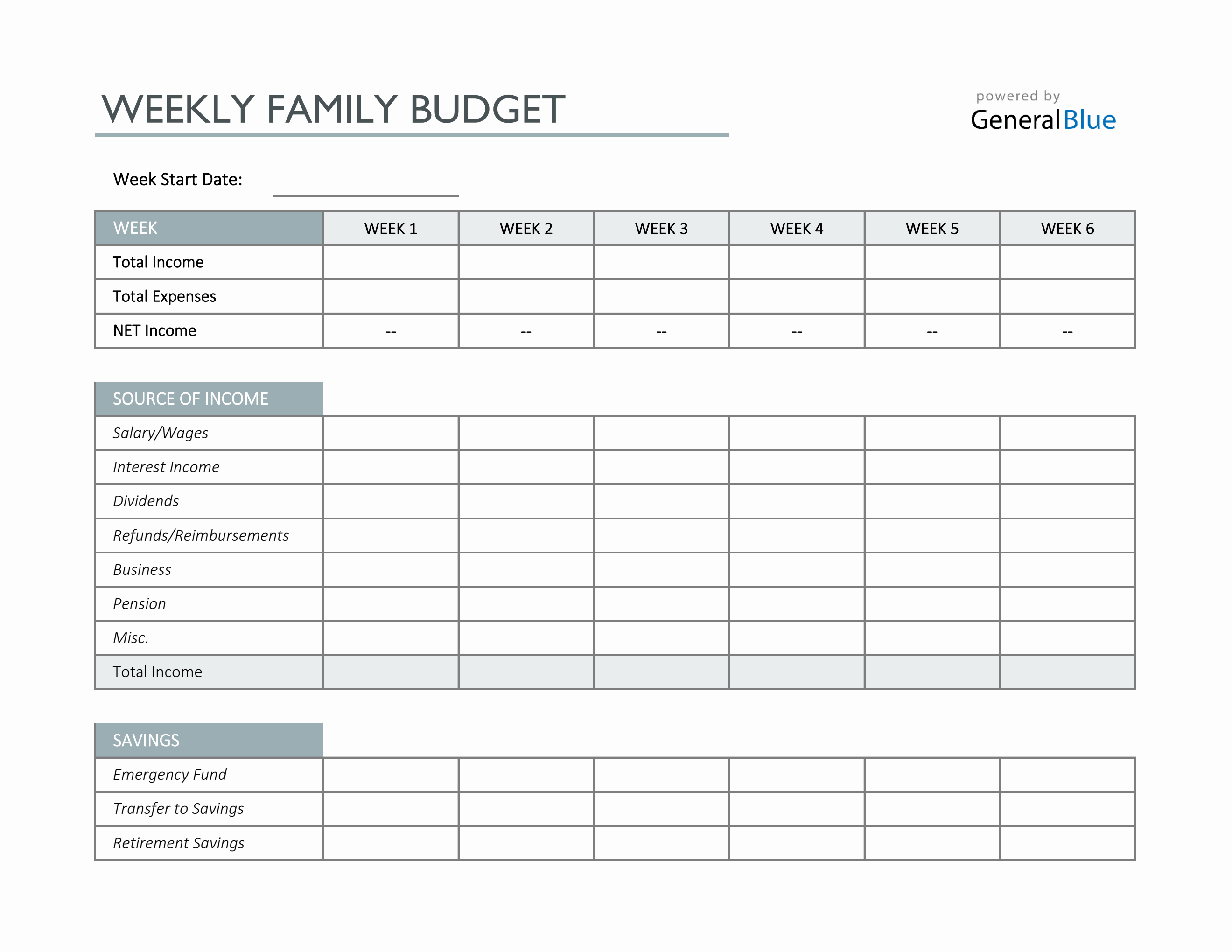

Download excel templates for business, department, project, home construction, or. Learn how to set up and maintain a monthly family budget (or small business or organization budget, personal budget, etc.) very easily in excel. In the first section on the top left hand side you.

Save time and money with these personal budgeting templates. Save your budget to your computer by using the excel spreadsheet version. The excel spreadsheet version allows for some customising (like.

Create an annual budget with this free family budget planner worksheet by entering. Get started on your personal finance journey with a budget template today. Learn how to use a free excel family budget template to manage your income, expenses, and savings for a certain period, such as a month, quarter, or year.

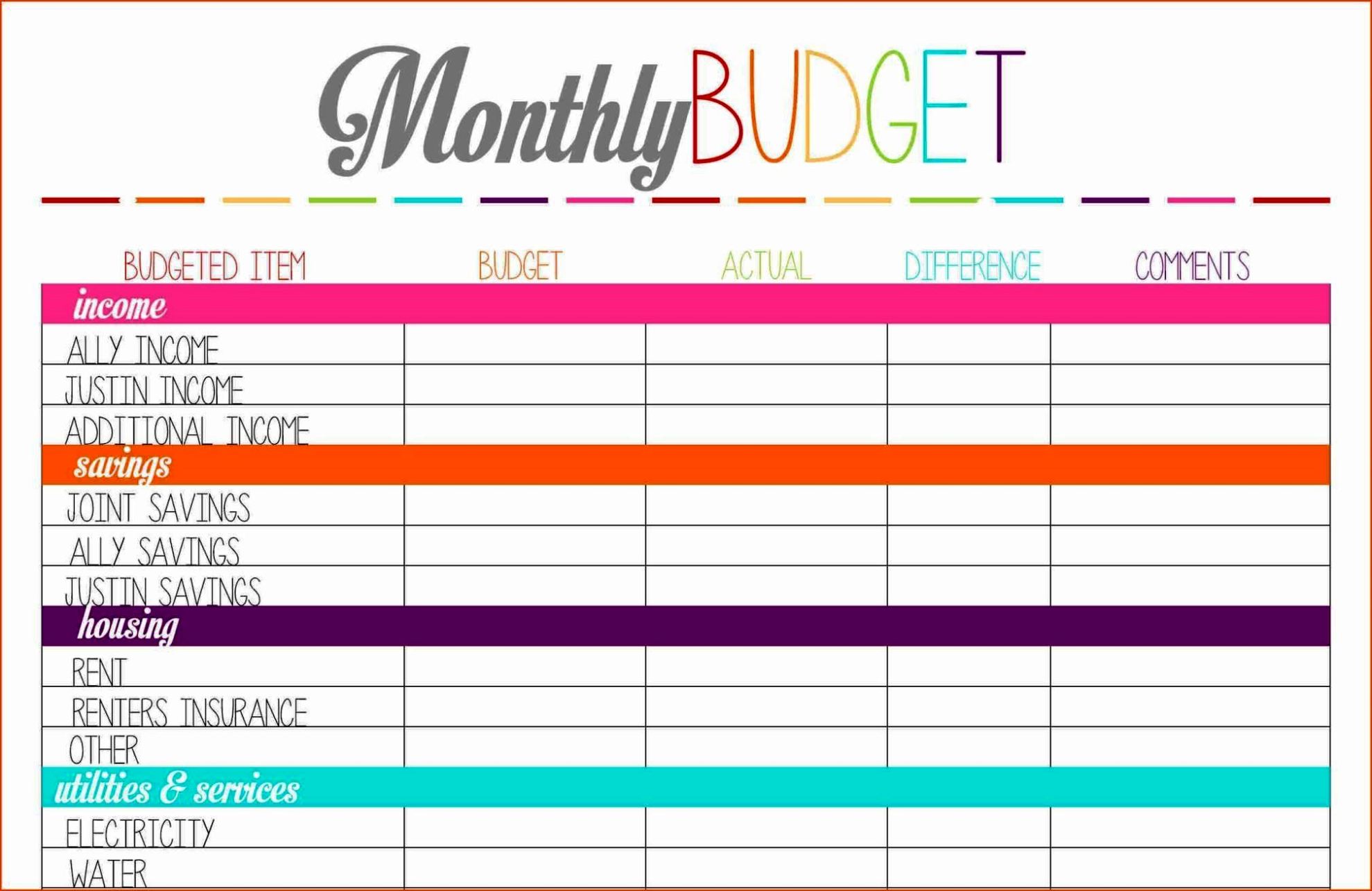

You can choose from them the one that suits your household or type of expenses the best. Identify your goals is your primary goal to pay off debt? A family budget is a plan for your household’s incoming and outgoing funds for a specific period, such as a month or year.

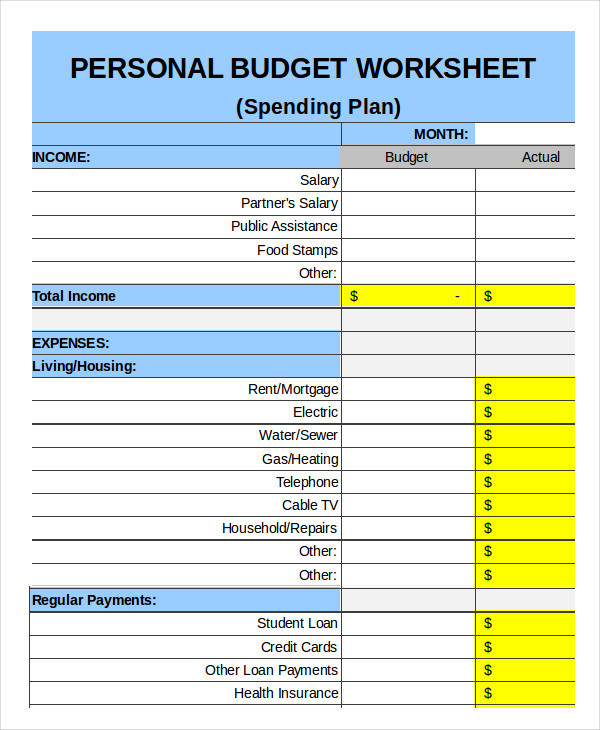

To find the family budget templates, open excel and click on the 'file' tab. Do you have a stable income and are just trying to organize. This planner is divided into three essential sections to help you plan your bills and keep track of your income on a monthly basis.

This is how they work: Lay the groundwork by compiling these financial records, as well as info on credit card debt, pension contributions and one.