Perfect Tips About Simple Expense Tracker Excel

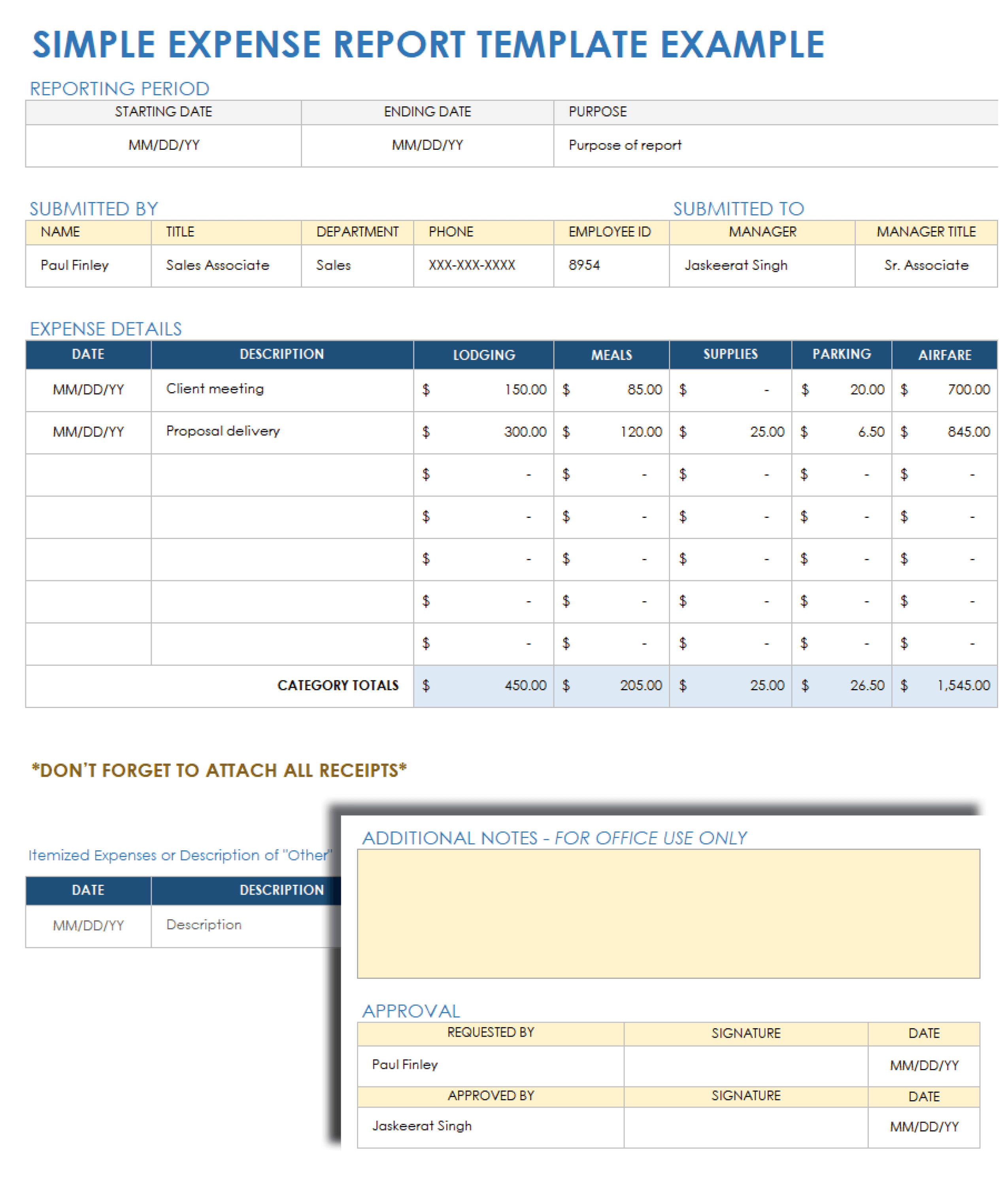

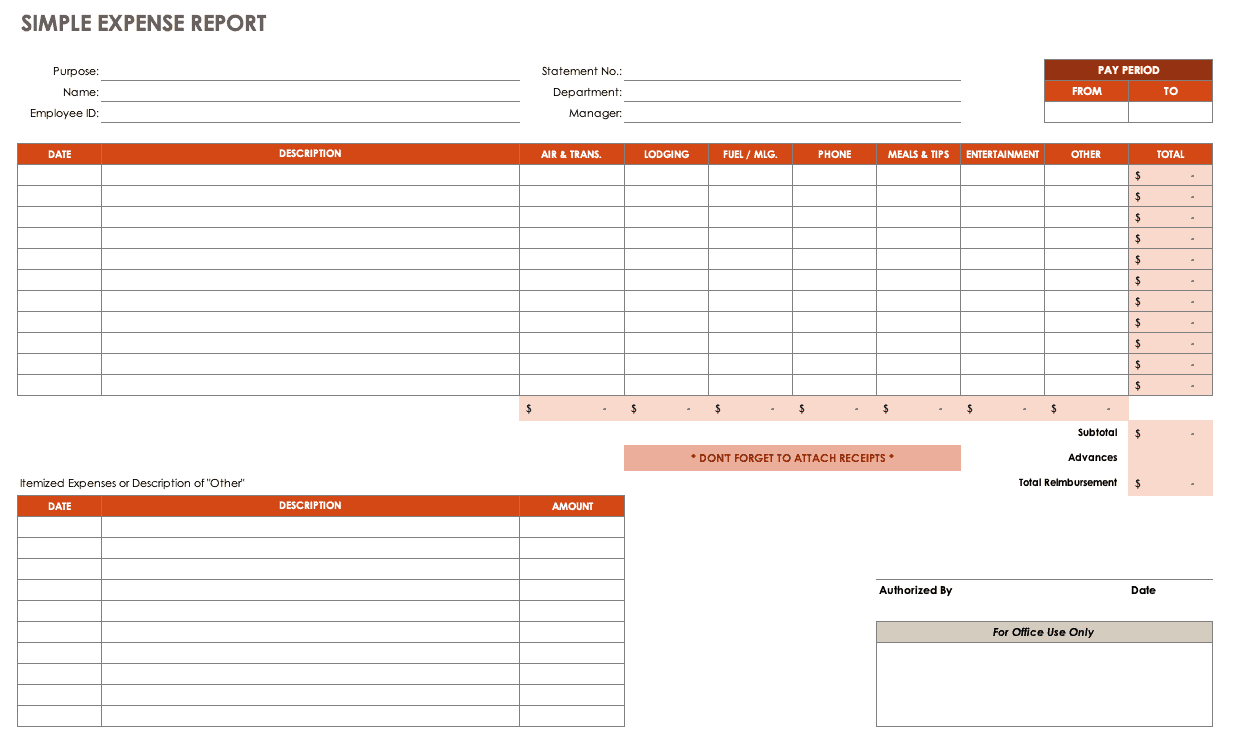

Here a preformated excel expense tracking template that allows you to keep track of all your expenses.

Simple expense tracker excel. Input your costs and income, and any difference is calculated automatically so you can avoid. Keeping track of your expenses is one of the fundamentals of living good life. With your essentials gathered, we have all the ingredients to customize an.

The best microsoft templates to track personal expenses in excel apart from providing excel software, microsoft offers several great templates for tracking. Use categories to organize your expenses. Track your expenses the easy way with excel.

For example, in this example we will make an expense tracker using microsoft excel, which will automate on the basis of what is entered in the tracker, it will. This simple income and expense tracker in excel format allows you to easily track the source of income, expenses, as well as the difference between projected and actual. Through customizable spreadsheets, microsoft excel makes it easy to create an expense tracker that fits all.

1.3 sort expenses to categories: Learn how to track and save your money with online tools that let you skip the setup and math. This sheetgo expense tracker template is ideal for small businesses and project teams — or anyone.

This excel template can help you track your monthly budget by income and expenses. Learn how to create a simple list of expenses and income in excel with a table, totals, and pivottables. Define a list of expenditure types relevant to your operations;

1.1 begin with a clean sheet: 1.2 list all the expenses: So i asked you to prepare a personal expense tracker as part of our 10,000 rss.

Want to keep track of your expenses. This is a simple and effective way to track your everyday expenses throughout the month and keep track of which expense category they belong in. Free excel budget templates for 2023.

Continue tracking to help you stick to your budget. Use pivot tables to analyze your expenses. Track your income and expenses.

Use that information to create a budget.